tax incentives for electric cars uk

If the car is leased solely for business purposes then VAT is fully deductible however if there is any personal use then only 50 VAT is deductible. Electric cars now hold more appeal.

Road Tax Company Tax Benefits On Electric Cars Edf

Of 20000 for first 200 orders after that up to a max.

. However this incentive has a. CO2 emissions zero emission range of at least 70 miles. For example a brand new electric vehicle costing 20000 could save 3800 of corporation tax in the year of purchase whereas a petrol or diesel car of the same cost but.

Nowadays buyers of small electric vans under 25 tonnes get a maximum grant of 35 of the list price capped at 2500. Aside from the electric car tax benefits outlined above. Everything mentioned is administered by OZEV.

20 of the cost of an electric taxi up to a maximum of 7500. This funding is available for models costing up to 32000. 20 of the cost of an electric van up to a max.

Thats a good idea in some. As an example a Tesla S compared with a Mercedes S 450 L AMG Line. Tax incentives for cars with lower CO2 emissions were introduced back in 2002 fuelling the subsequent dash for diesel and creating an early market for plug-in hybrids a decade later.

The governments plug-in car grant is designed to promote the uptake of electric vehicles in the UK. The grant offers a discount of up to 3000 on the price of an electric car and 350 on the cost of installing a charger. The staff benefit is a UK Government tax incentive and works via a salary sacrifice scheme.

There are significant tax advantages for business owners. To be eligible for the grant the car must have a recommended retail price RRP of less than 32000 including VAT and delivery fees. The Plug-In Car Grant covers 35 of the cost of a car up to a maximum of 4500 depending on the model and 20 of the cost of a van up to a maximum of 8000.

20 of the cost of an electric motorcycle or moped up to a max. CO2 emissions of 50-75gkm and a zero emission range of at least 20 miles. For bigger vans the cap is 5000.

Company car tax rates start from around nine per. From 18 March 2021 the government will provide grants of up to 2500 towards the cost of an eligible plug-in vehicle where it costs less than 35000. 20 of the cost of a large electric van or truck up to a maximum of 20000 for the first 200 orders after that up to a maximum of 8000.

400m of this amount is dedicated to improving charging infrastructure for electric vehicles. The UK government pledged a 540m sum to boost the industry of low emission vehicles. Exploring the benefits of electrical vehicles alongside the government range of tax incentives for businesses you can refer to the list of vehicles eligible for the governments plug-in grant.

To claim you must own lease or have ordered a qualifying vehicle and have dedicated off-street parking at home. Of 20000 for first 200 orders after that up to a max. CO2 emissions zero emission range between 10 and 69 miles.

At present there are only 50 electric vehicles registered as company cars out of 11 million company cars on the road. Not paying tax on electric vehicles is essentially a Government incentive. Electric Car Tax Benefits in kind cost to company.

Speaking to Expresscouk he said. Therefore this will cease to apply for higher priced vehicles. This is in contrast to cars with emissions of 51-110gkm or above 110gkm on which you can only claim writing down allowances of 18 and 8 per year respectively.

Electric Car Tax Benefits. Its to incentivise you to go electric. From today 18 March 2021 the government will provide grants of up to 2500 for electric vehicles on cars priced under 35000.

This rate also applies to hybrid vehicles with a CO2 emissions figure of below 50gkm and a pure electric range of 130 miles. 20 of the cost of a large electric van or truck up to a max. The current rate for tax-year 202223 for pure electric vehicles is 2.

Tax on Benefits in Kind BiK Effective from 6th April 2020 fully electric cars will be zero BiK for 202021 1 for 202122 and 2 for 202223. Drivers who find themselves requiring access to the London Congestion Charge Zone. Grants for electric vans and motorbikes are also available but these too have been significantly reduced over the years.

The BiK rate will rise to 2 percent in 202223 being held at 2 for 202324 202425. This ends up saving drivers between 30 and 60 percent on an electric vehicle of. Is the federal electric car tax credit of up to 7500.

Electric van can reduce their cost by 20up to a maximum of 8000. 20 of the cost of a large electric van or truck up to a max. The 35 cap still applies.

The Electric Vehicle Homecharge Scheme EVHS provides a grant of up to 75 percent or up to 350 including VAT towards the cost of installing an EV charge point at your domestic property. There are many incentives for buying an electric car in the UK including plug-in grants for low emission vehicles zero or reduced road tax bills and accessible on-the-go electric charge points across UK road networks. Besides beating the high cost of gas one of the perks of owning an electric vehicle in the US.

Following a recent overhaul that system has made company car schemes among the most affordable ways to drive an electric vehicle. There are further financial incentives associated with driving an electric vehicle. 20 of the cost of an electric van up to a max.

20 of the cost of an electric motorcycle or moped up to a max. 20 of the cost of an electric taxi up to a max. In addition they can choose a more environmentally friendly way to operate their business.

So tax relief for leasing an electric car is given each year depending on the cost and business use contrasted with outright purchase which provides an initial and one-off tax deduction. Tax incentives grants. The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent.

Company Car Tax Benefit in Kind From 6th April 2021 both new and existing Tesla cars are eligible for a 1 percent BiK rate for the 202122 tax year. 20 of the cost of an electric taxi up to a max.

The Tax Benefits Of Electric Vehicles Saffery Champness

Ev And Ev Charger Incentives In Europe A Complete Guide For Businesses And Individuals

Road Tax Company Tax Benefits On Electric Cars Edf

Road Tax Company Tax Benefits On Electric Cars Edf

Updated Electric Car Grant Cut To 2 500 And Eligibility Changed Electric Fleet News

Government Electric Car Grants Save On Your Ev Leasing Options

Purchase Subsidies Zero Rate Tax And Toll Free Travel How To Incentivise Emobility Skoda Storyboard

Which Governments Are Promoting Electric Vehicles The Most

Changes To Company Car Tax Wltp For Ulevs A Move Back To Company Cars

A Complete Guide To Ev Ev Charging Incentives In The Uk

A Guide To Company Car Tax For Electric Cars Clm

The Tax Benefits Of Electric Vehicles Saffery Champness

Incentives And Grants For Electric Cars And Vans Vwfs Fleet Vwfs Fleet

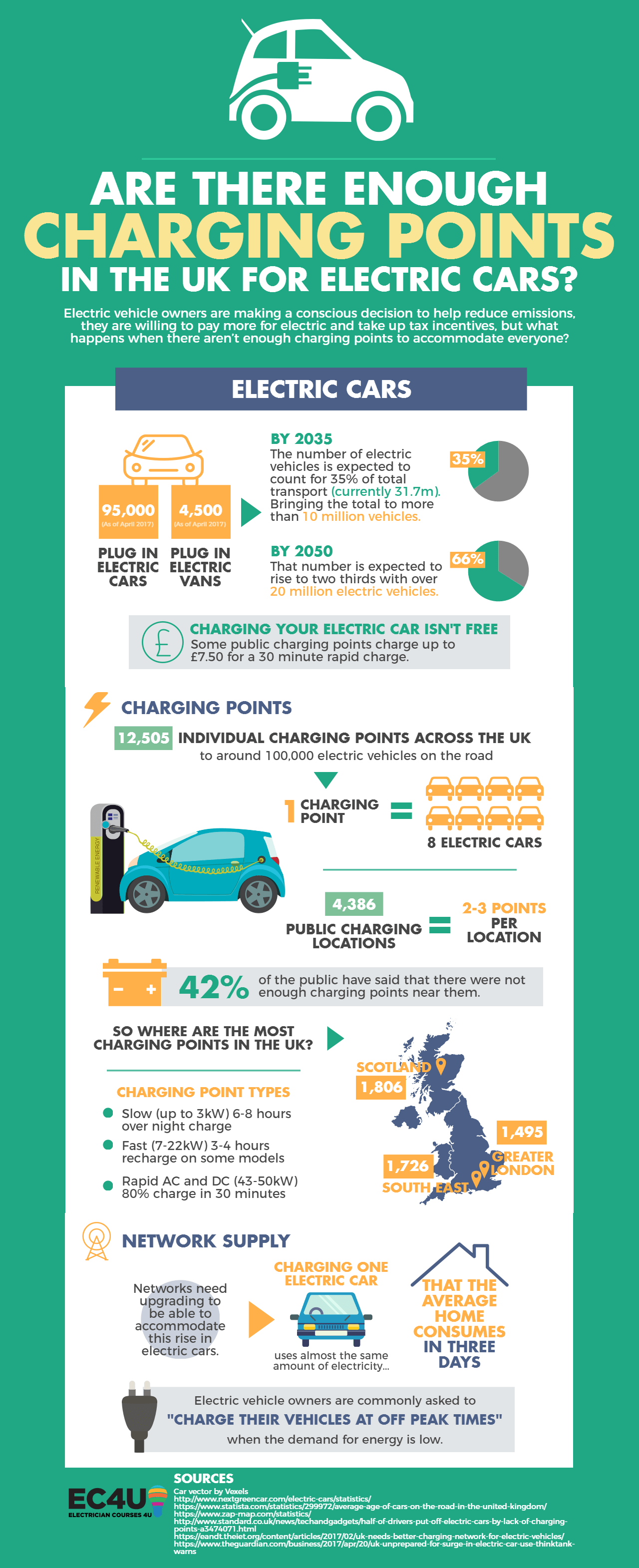

Are There Enough Charging Points In The Uk For The Number Of Electric Cars

Which Governments Are Promoting Electric Vehicles The Most

What S Put The Spark In Norway S Electric Car Revolution Motoring The Guardian

The Tax Benefits Of Electric Vehicles Taxassist Accountants

How Europe Promotes Electric Vehicles A Brief Insight On Best Practices Transport Turkey

Tax On Company Cars Does It Pay To Go Electric Rouse Partners Award Winning Chartered Accountants In Buckinghamshire